Share Certificate Franking and Stamping

Overview : Discover the essential guide to Share Certificate Franking and Stamping in India. This comprehensive resource delves into the intricacies of share certificate issuance, franking, and stamping, providing a step-by-step understanding of the process. From legal obligations to potential penalties for non-compliance, readers gain valuable insights to ensure timely and accurate compliance. Whether you’re a company director or shareholder, this blog equips you with the knowledge needed to navigate the complexities of share certificate compliance effortlessly.

The issuance of share certificates to all shareholders is a mandatory compliance for all companies registered in India, be it an OPC, a private company or a public company. Such companies are required to issue Share Certificates within 60 days from the date on which the shares were bought, or within 60 days from the date of registration of the company. Moreover, the share certificates are required to be stamped within 30 days from the date of issuance of shares. It is necessary that these compliances are fulfilled on time, as a delay would result in the imposition of gruesome penalties. Read the entire article to get a thorough understanding of the need, procedures and penalties of the concerned compliances.

What is a Share Certificate?

All Indian Companies, be it an OPC, a private company, or a public company, are required to issue share certificates to their shareholders as a conclusive legal proof of their contribution to the capital of the company. As soon the shareholders buy the shares issued by the company, they are issued a share certificate under the seal of the company, which implies that they shall henceforth be entitled to the ownership of the company. The details mentioned in a share certificate includes the name, CIN, and the registered office address of the company, the name of the concerned shareholder, the number of shares purchased, and the value at which the shares have been purchased by the concerned shareholder.

Issuing a share certificate is mandatory for the company, within 60 days from the date on which the shares were bought by the shareholders. The Companies Act does not prescribe any specific location from where the share certificates can be issued. Hence, as long as the Board Of Directors are available to call a meeting and approve the issue of the share certificates, they can be issued from anywhere in India. Section 3 of the Indian Stamp Act makes it mandatory for every share certificate to be stamped under the seal of the government. For this, the company shall bear the stamp duty in accordance with their prevailing rates in different states and Union Territories. The stamp duty must be paid even if the share certificates are issued in dematerialized format. It must be noted that the stamp duty on the share certificate is payable on the issue price, and not on the par/ nominal value, of the shares.

What is Share Franking and When Is It Required?

Franking essentially means embossing stamps and stamp duties on documents like the share certificates. It is one of the many ways by which a company pays stamp duty to the government. The detailed process of franking involves impressions made on share certificates using a Franking Machine, which is usually installed in the office of the Sub Registrar or Collector of stamp duty. These machines can affix impressions of up to Rs.999 on stamp paper. An application must be appropriately made to the office of the Sub Registrar with a request letter for franking the share certificates.

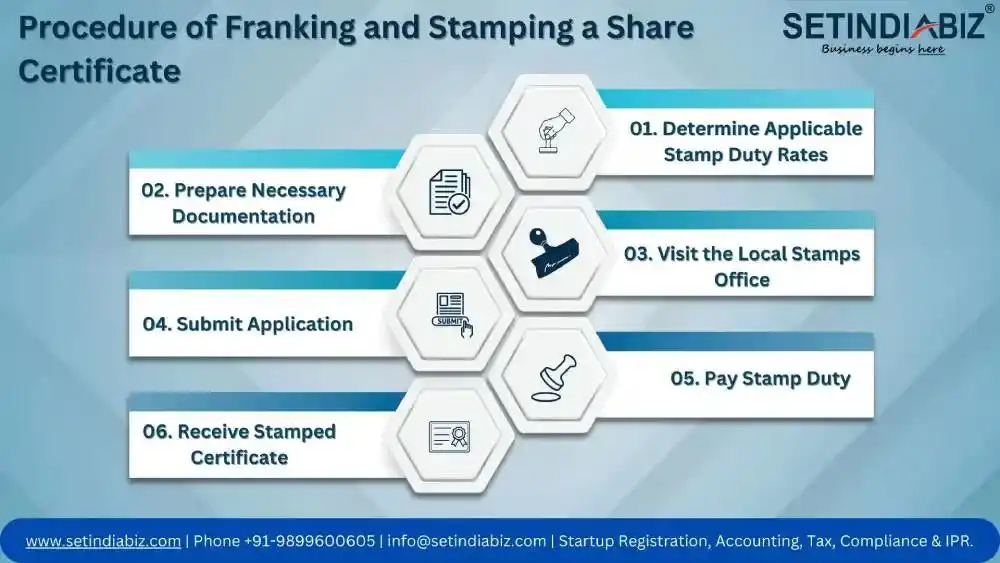

What is the Procedure of Franking and Stamping a Share Certificate?

The procedure for franking and stamping a share certificate varies differently across different states of India and depends on their respective Stamp Acts. This is because stamp duty falls under the jurisdiction of the state governments. However, just to provide a brief overview, here are the general steps to be followed during the process. Note that these steps are generic and the actual requirements must be looked up in the Stamp Act of the state itself.

- Determine Applicable Stamp Duty Rates: Understand the prevailing stamp duty rates applicable to share certificates in your state. These rates can vary based on factors such as the value of shares issued and local regulations.

- Prepare Necessary Documentation: Gather all required documentation, including the share certificate itself and any supporting paperwork, such as shareholder details and transaction records.

- Visit the Local Stamps Office: Identify the designated authority responsible for stamping and franking share certificates in your jurisdiction. This could be the office of the Sub Registrar or Collector of Stamp Duty.

- Submit Application: Apply for stamping and franking of the share certificate to the designated authority in the local Stamps Office. This may involve filling out specific forms or providing relevant information as per local requirements.

- Pay Stamp Duty: Pay the applicable stamp duty fees as per the prescribed rates. This could involve affixing physical stamps or using electronic means, depending on the process followed in your state.

- Receive Stamped Certificate: Once the stamp duty is paid and the share certificate is duly stamped and franked, it will be returned to you by the designated authority. Ensure that the certificate bears the necessary stamps and endorsements to validate its legality.

Note : Keep detailed records of the stamping and franking process, including receipts for stamp duty payments and copies of stamped certificates, for future reference and compliance auditing

What is the Stamp Duty on Share Franking and Stamping of Share Certificates?

A recent amendment of the Indian Stamp Rules, effective from 1st July 2020, has changed the rate of stamp duty charged across India. Prior to the amendment, the applicability and the rates of stamp duty on share certificate differed for different Indian states. This created a lot of confusion, chaos, and inconvenience among people. Consequently, the changes made in the new amendment prescribes a uniform stamp duty on share certificates issued across all states in India. The rate of the duty so prescribed is 0.005% of the Value of Share. The affordability of the rate of stamp duty is an added advantage for taxpayers across India. The duty will still be levied and collected by the state governments.

What is the Penalty on Late Payment of Stamp Duty on Share Certificates?

The stamp duty on Share Certificates must be paid within 30 days from the date of issuance of the Share Certificate. Timely payment of stamp duty is crucial as it not only ensures compliance with regulatory requirements but also serves as a legal obligation. Failure to pay the stamp duty within the prescribed deadline can result in severe penalties. The concerned authority may impose a penalty of up to 10 times the amount of duty payable. This hefty penalty underscores the importance of prompt compliance and highlights the potential financial consequences of non-compliance. By paying stamp duty on time, companies and shareholders can avoid unnecessary penalties and safeguard against legal complications, thus ensuring smooth operations and preserving their financial integrity.

Conclusion

Franking and stamping of the share certificates issued by the company is a major compliance that if neglected, can land the company in a pool of penalties. Thus, it is advisable that the company issues stamped share certificates to all its shareholders as soon as they buy its shares. If you lack the complete information and knowledge of the procedure for applying for stamping of the certificates, you must seek professional guidance and services for the same.