Transfer of Shares in a Private Company – Share Transfer Procedure, Transfer of Shares

Overview : Share transfer Procedure in a private limited company is the process of transferring ownership from one shareholder to another. The share transfer process in a private limited company takes place to transfer ownership or induct interested investors into a company. This quick guide covers the share transfer procedure in a private limited company along with essential aspects associated with share transfer.

The Share Transfer Procedure in a private limited company enables the transfer of ownership from one shareholder to another. A share is in the form of ownership rights in a company, possessing the nature to be bought, sold, or even transferred. The share transfer process in a private company is initiated to transfer ownership or induct interested investors into a company voluntarily.

SetIndiabiz’s team of legal experts offers end-to-end assistance in the procedure of transferring shares in a private limited company to ensure a smooth and seamless experience. Our team possesses expertise in the procedure to transfer shares in a private limited company, thereby ensuring a hassle-free share transfer in a company.

Understanding Share Transfer in Pvt Ltd Companies

Share Transfer refers to the process of voluntarily transferring ownership rights by a shareholder to any other person with the consent of other existing shareholders in the case of a private limited company. In other words, the share transfer in a private limited company is restricted and can take place only with the consent of other shareholders; this concept is known as the ‘Right of Preemption’ or the ‘Right Of First Refusal’.

Simply put, the existing shareholders must first be offered the shares by the person who intends to transfer or sell his shareholding. The existing shareholders possess complete discretion to accept the proposal and purchase the shares or refuse such an offer of share transfer.

Once these shareholders refuse to purchase the offered shares, those shares can be offered to any person or party in the public. In private limited companies, shares are transferred through a formal agreement between a transferor and the transferee. However, in the case of Public Limited Companies, the share transfer is freely possible.

Key Parties Involved in Share Transfer Procedure

- Transferor: The shareholder who intends to transfer his shares.

- Transferee: The individual or party who intends to acquire shares.

- Board of Directors: Responsible for overseeing the whole procedure of transferring shares and also approving the transfer of shares.

- Other Shareholders/Company: The private limited company whose shareholder has intended to pass on his shares.

Checklist for Share Transfer in a Private Limited Company

In order to execute the share transfer process in private limited companies smoothly, it’s necessary to meet the checklist below for the necessary documents;

- Share Transfer Deed

- Photocopy of Transferee’s PAN Card

- Share Certificate

- No Objection Certificate (NOC) from other Shareholders

- Resolution of Board

- Stamp Duty Payment

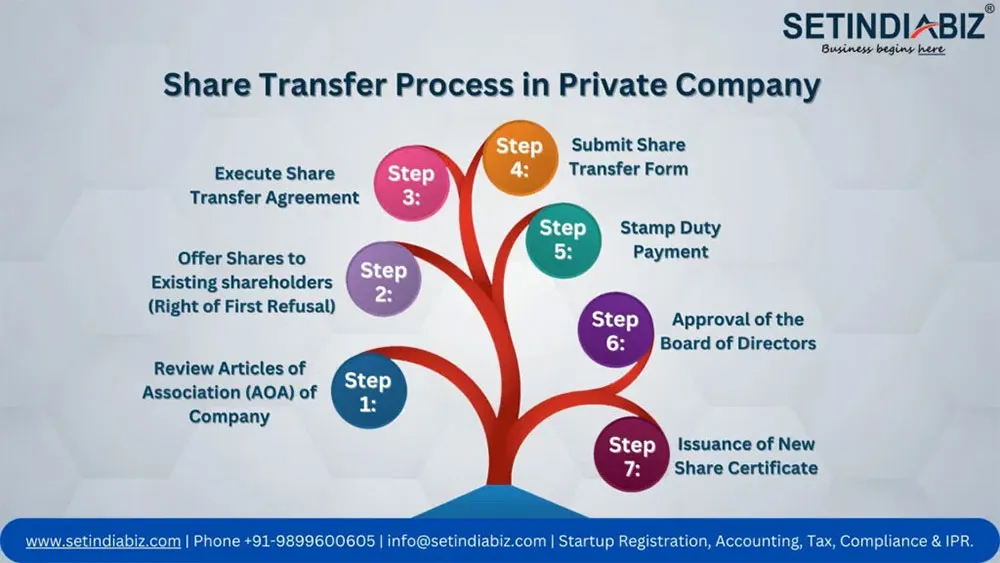

Share Transfer Process in Private Company

The steps required to initiate the share transfer process in the private company are described below;

Step 1: Review Articles of Association (AOA) of Company

Before initiating the share transfer process, it’s essential to go through the AOA and any existing shareholders Agreement meticulously. These documents may include some specific provisions pertaining to the transfer of shares i.e. pre-emption rights or approval requirements.

Step 2: Offer Shares to Existing shareholders (Right of First Refusal)

When a shareholder intends to discontinue his association with a company, he proposes to sell/transfer his shares. In this case, he primarily has to inform the existing shareholders of the company under the contractual obligation termed ‘Right Of First Refusal’.

It ensures that the existing shareholders have the first opportunity to either accept or refuse the offer to purchase shares. Once no existing shareholders are interested in buying the offered shares, they can be offered to any outsider person or party who is interested in acquiring such shares.

Step 3: Execute Share Transfer Agreement

Once all the required approvals are obtained, a Share Transfer Agreement is prepared. The agreement highlights the terms and conditions of the share transfer, including the number of shares, consideration amount, any warranties or representations, etc.

Step 4: Submit Share Transfer Form

Post-execution of the Share Transfer Agreement, both the parties (transferor & transferee) must complete a Share Transfer Form, which is the SH-4 Form prescribed under Section 56 of the Companies Act 2013. Moreover, some other relevant documents & formalities must be met, such as share certificates and Board resolutions approving the share transfer.

Step 5: Stamp Duty Payment

In India, share transfers are subject to stamp duty under the relevant state laws. The stamp duty amount varies as per the state’s laws where the company is registered and the value of shares being transferred. The share transfer agreement must be stamped with the applicable duty to be considered legally enforceable.

Step 6: Approval of the Board of Directors

In some cases, approval from the Board of Directors is required for shares transfer. Some additional approvals may also be required such as shareholder approval or compliance with regulatory requirements; depending upon the internal policies of the company and governing documents.

Step 7: Issuance of New Share Certificate

Upon submission of the Share Transfer form and other relevant documents, the company’s Board of Directors verifies the transfer and also updates its records accordingly. On successful verification, the company issues a new share certificate to the transferee that outlines their ownership of the transferred shares.

Note : The aforementioned share transfer process applies if the shares are transferred to an Indian resident. However, if the shares are transferred to a Non-Resident or Foreigner, a different process needs to be followed.

Conclusion

Share transfer in a public limited company can be done easily as it contains no or minimal restrictions, however the share transfer in a private limited company can be executed adhering to the terms & conditions depicted in AOA of the company. Following the detailed process of share transfer in a Pvt Ltd company can ensure transfer shares smoothly in a private limited company.

FAQ’s

- FEMA declaration

- RBI Approval

- Few other documents for KYC as per FDI guidelines