Income Tax Refund Procedure in India: Types & Step-by-Step Guide

Author: Editorial Team | in, Updated on: October 16, 2024

Overview : Consider a situation where you have paid your income tax and later while filing its return realize that the amount you paid was more than what is due. Several questions started popping up in your mind i.e. what next steps to take to get my overpaid amount, whether I will get my overpaid money refunded or not and many more. This blog will answer all your questions related to ITR processed with refund due along with the overpaid amount.

The Income Tax Department recognizes the struggle that taxpayers go through while paying their taxes. In the hustle bustle of deadlines and due dates, making incorrect calculation of their payable income tax returns is common and each year many taxpayers end up paying an excess itr amount than their actual one. To save taxpayers from any loss, the income tax department has introduced the ITR refund facility, where it issues a refund of the excess tax to the taxpayer’s account as soon as his ITR is processed or within ITR refund processing time.

Income Tax Refund Calculation

Income Tax Refund is the difference between tax paid and tax payable by a taxpayer. Ideally, the two should be the same. However, sometimes the taxpayer makes a mistake in assessing the tax during its payment and ends up paying an excess amount than what is due in the ITR.

This happens if the taxpayer has not claimed the eligible exemption and deductions, or has assessed the tax payable incorrectly. In such cases, the tax department initiates a refund of excess tax paid to the taxpayer’s account soon after the ITR is processed. Note that the refund amount includes TDS, self-assessment tax, and advance tax.

How to Check ITR Refund Status Online?

Before beginning the Income tax refund procedure, the taxpayer must file his ITR on time. If there is any delay in the filing of ITR, make sure the “belated returns” get filed on time. The due date to file “belated returns” is 31st December in the relevant assessment year. Also, ensure that the PAN and Aadhar of the taxpayer are linked before the refund is initiated. You can initiate the checking of ITR refund process status; online or offline.

Worried about your tax refund status, checking the status of Income tax refund procedure in India can be beneficial in knowing the status of ITR refund.

There are three different ways to check Income tax refund procedure in India which are listed below;

1. Using Income Tax Portal

Step 1: Log in to eFiling Portal

Go to the Income Tax Portal and enter the login credentials to log in to your account.

Step 2: Click on ‘e-File’

Click on the ‘e-File’, then go to ‘Income Tax Returns’ followed by selecting ‘View Filed Returns’.

Step 3: Check status of your Income Tax Returns

Now, the status of your previously filed income tax returns gets visible on your screen.

Step 4: Click on ‘View Details’

Click on ‘View details’ and you will see the status of your income tax refund.

2. Using NSDL Portal

Step 1: Visit NSDL Portal

Visit NSDL Portal to initiate ITR Refund status checking procedure.

Step 2: Provide PAN information

Enter your PAN details, choose the appropriate Assessment Year from the drop-down menu for which you want tax refund status then enter the Captcha Code.

Step 3: Move further with Taxpayer Refund (PAN)

Click on ‘Proceed’ under the ‘Taxpayer Refund (PAN)’ category displaced. Moreover, you will be directed to a page that will display the ‘Refund Status’.

3. Using TRACES

Step 1: Login to ITR Portal

Visit the official Income tax Portal and log in with required credentials.

Step 2: Click on ‘View Form 26AS’

Click on ‘e-File’ then select ‘Income Tax Returns’ and click on the ‘View Form 26AS’

Step 3: Click on ‘View Tax Credit’

In this step, you will be taken to the TDS Reconciliation Analysis and Correction Enabling System (TRACES) page and then Click on ‘View Tax Credit (Form 26AS/Annual Tax Statement) at the bottom of the page.

Step 4: Select ‘Assessment Year’

Choose the Assessment Year from the given drop-down menu for the same, then select view as ‘text’.

You are redirected to a page that shows the details of the refund paid.

What are the ITR Statuses One can Receive?

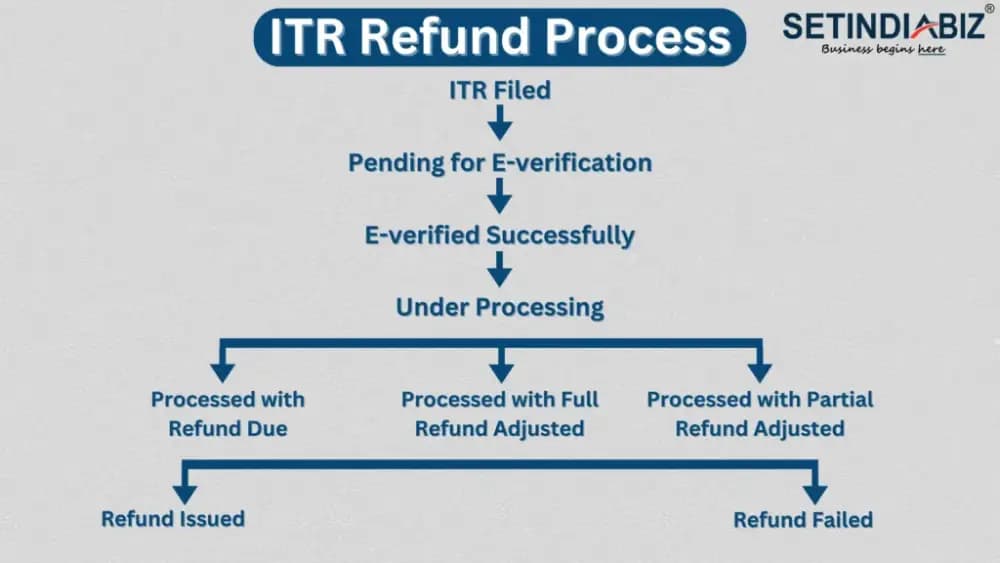

The income tax refund procedure starts with the filing of an ITR. So the first status you will see is “ITR Filed” The processing of the filed ITR begins with its e-verification. Until the e-verification is completed, you will see the status “Pending for E-verification”. The status will change to “E-verified successfully” once the verification process is completed. The processing of ITR begins at this stage.

Up until the processing period, its status shows “Under Processing. Once the itr has been processed with refund due, the status changes to “Processed with Refund Due”. If the Refund has been adjusted, the status accordingly updates to “Processed with Fully Adjusted Refund” and “Processed with Partially Adjusted Refund”, as the case may be. Immediately after this status, the Department will issue the Refund to the Taxpayer, and the status will be updated to “Refund Issued”.

At this point, the taxpayer must check his account to ensure the receipt of the refund amount. If the refund has not been received, the taxpayer must wait for an intimation from the Income tax department.

Can Income Tax Refund Get Delayed?

Usually, the taxpayer receives the refund amount within 4 to 5 days of payment initiation. However, the refund may get delayed due to several unprecedented reasons. In such circumstances, keep checking the registered email or contact number for any information from the Income Tax Department or track the ITR refund status online on the Income Tax or NSDL website. If you’re wondering why tax refunds get delayed, here are a few common reasons:

- High Workload at Income Tax Office: Refunds may get delayed if the Income Tax Office is overburdened with work. This especially happens during the peak tax season or around compliance due dates.

- Incorrect Tax Returns: If the Income Tax Returns contain incorrect information, incomplete documents, or mismatched data, the processing of ITR and refund both gets delayed.

- Long Verification Process: The Department may take some time to process and verify the filed ITR. Unless successfully verified by the authorities, no refund will be initiated.

- Technical Issues: Sometimes, technical issues at the bank may delay the refund process. In that case, contact the banker immediately for clarification.

- Changes in Laws: Changes in tax refund laws may delay the refund process as the Department takes its time to adjust to the new laws.

Interest on Income Tax Refund

The income tax department pays interest on the refund amount at 0.5% rate per annum from 1st April till the date on which the refund is paid. This interest compensates for any delays made in the refund payment process. However, if the refund amount is less than 10% of the tax payable, no interest will be paid on it.

ITR Refund Process Failed

The ITR refund process may or may not succeed after the processing of ITR. If the ITR refund status shows “failed”, the taxpayer can file a Reissue Request to the Department in such circumstances. If this request gets approved the Department will consider attempting to reissue the ITR refund to the taxpayer again.

Reasons for ITR Refund Failure

- ITR refund process fails if:The bank account number, IFSC code, or other details of the taxpayer are inaccurate

- The taxpayer’s PAN details get mismatched

- Taxpayer’s identity gets forged

- Technical issues at Bank or Income Tax Website

Conclusion

ITR Refund facility is a relief for taxpayers who have paid excess tax to the Income Tax Department. The process is convenient as there is no need to apply separately. As soon as the ITR is filed and processed, the refund is issued to the taxpayer’s bank account within ITR refund processing time. There might be payment failures due to several reasons. If you are facing any issue while undergoing the ITR refund process, consult our experts on how to proceed next throughout the Income tax refund procedure.

FAQs

Author Bio

Editorial Team | in

Setindiabiz Editorial Team is a multidisciplinary collective of Chartered Accountants, Company Secretaries, and Advocates offering authoritative insights on India’s regulatory and business landscape. With decades of experience in compliance, taxation, and advisory, they empower entrepreneurs and enterprises to make informed decisions.