What are the Documents Required for GST Registration of Partnership Firm and LLP?

Overview : This blog on Partnership Firm/LLP GST Registration documents outlines the essential documents required for GST registration for Partnership Firms and LLPs, offering deep insights into their significance, preparation, and submission process. From partnership deeds to LLP agreements, PAN cards to address proofs of partners, etc, the blog aims to discuss every document to provide a clearer picture. Read it out thoroughly to get complete information on ‘documents required for GST Registration for Partnership firm and LLP’.

Goods and Services Tax (GST) registration is a crucial legal requirement for businesses across India, including partnership firms and limited liability partnerships (LLPs). Under the GST regime, businesses exceeding the prescribed turnover threshold are mandated to obtain registration to comply with tax laws and facilitate seamless operations. For partnership firms and LLPs, GST registration is particularly significant as it enables them to conduct transactions efficiently, avail input tax credits, and comply with regulatory obligations.

Introduction to GST Regime in India

GST is a unified indirect tax system that replaces various central and state taxes in India, thereby simplifying the overall tax structure and promoting the ease of doing business. It aims to streamline the taxation process, reduce evasion of taxes, and foster economic growth under the key concept of the “One Nation, One Tax Regime”.

The applicability for GST is determined by a business’s annual turnover, which if exceeds the prescribed threshold, makes GST Registration mandatory for businesses. GST registration enables businesses to collect and remit GST on their supplies, claim input tax credits, and file timely GST returns. Moreover, it provides a unique GST Identification Number (GSTIN) to track the GST compliance status of businesses as well.

Eligibility for GST Registration of Partnership Firms & LLPs

Before understanding the process and documents required for GST Registration for LLP & Partnership firms, it is necessary to get a grasp of its eligibility criteria. This is basically to understand under what circumstance is your business applicable for GST Registration.

In order to determine it, you must be aware of three broad categories of businesses– the first category comprises businesses that exceed the prescribed threshold, the second category comprises businesses for which GST Registration is mandatory, irrespective of turnover, and the third category comprises businesses that are exempt from this requirement altogether. Let’s understand each of these categories one by one.

Prescribed Threshold for GST Registration

The primary determinant for GST Registration is the annual turnover of the business during the previous financial year. If it exceeds the limit of Rs.40 lakhs in the case of merchandise businesses, or Rs.20 lakhs in the case of service providers, GST Registration becomes mandatory. However, this turnover has been reduced to Rs.10 lakhs in the case of businesses in hilly and north-eastern states.

Businesses For Which GST Registration is Mandatory

- E-commerce operators/ aggregators

- Businesses selling on e-commerce platforms

- Casual Taxpayers

- Business non-resident in India

- Importers & Exporters

- Taxpayers under GST Reverse Charge Mechanism

- Taxpayers registered under the older tax regime

- Businesses engaged in Inter-state supplies of goods & services

- Service Providers providing information & online databases services (OIDAR)

Businesses Exempted From GST Registration

Section 23 of the CGST Act, 2017 provides a complete exemption from the requirement of obtaining GST registration in India for certain businesses, regardless of whether they have exceeded the prescribed turnover limits. These exempted entities include businesses whose turnover has not crossed the threshold limit mandated for GST registration, agriculturalists who supply agricultural produce sourced from their land, and any other entity notified by the Government.

These provisions aim to simplify compliance for small-scale enterprises and ensure that businesses engaged in specific sectors are not burdened with unnecessary regulatory requirements.

Documents Required for GST Registration for LLP & Partnership Firm

GST registration is a pivotal step for partnership firms and Limited Liability Partnerships (LLPs) in India, ensuring legal compliance and enabling smooth business operations in the realm of taxation. Proper documentation plays a crucial role in this process as it serves as evidence of the firm’s existence, ownership structure, and financial details.

The documents requirements for LLP GST registration or partnership firms not only facilitate the verification process by the tax authorities but also contribute to establishing the credibility and legitimacy of the partnership firm or LLP. Let’s explore the specific gst documents required for partnership firms or LLPs.

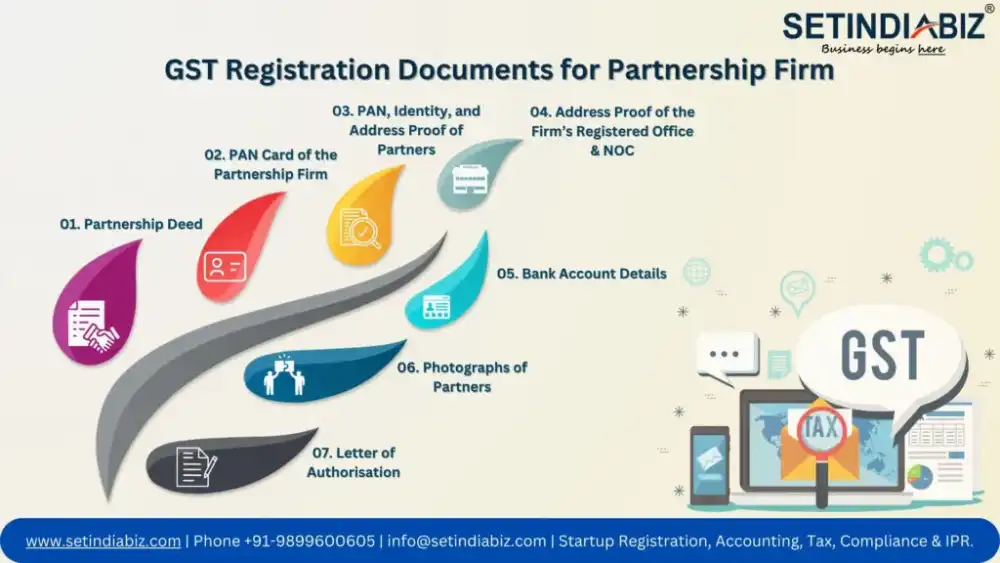

GST Registration Documents required for Partnership Firms

Partnership firms are required to furnish a set of documents to complete the GST registration process efficiently. These documents serve as proof of the firm’s existence, ownership structure, and financial details, ensuring compliance with tax laws and facilitating seamless transactions. The following are the essential documents required for GST registration for partnership firms:

- Partnership Deed: A legally binding document that outlines the terms and conditions of the partnership, including details of the partners, profit-sharing ratio, and business activities.

- PAN Card of the Partnership Firm: A Permanent Account Number (PAN) issued by the Income Tax Department, serving as a unique identifier for the partnership firm.

- PAN, Identity, and Address Proof of Partners: Documents such as an Aadhaar card, passport, voter ID, or driver’s license as identity proof, along with utility bills or bank statements address proof, and PAN of all partners for authentication.

- Address Proof of the Firm’s Registered Office & NOC: Documents establishing the registered office of the partnership firm, such as rent agreement, lease deed, or property tax receipt. Further, a No Objection Certificate will be required from the premises owner, whether it is rented or self-owned.

- Bank Account Details: Details of the partnership firm’s bank account, including the bank statement or passbook.

- Photographs of Partners: Passport-sized photographs of all partners, duly attested.

- Letter of Authorisation: A Letter authorizing the applicant / authorized signatory to sign the incorporation application on the company’s letterhead. The authorization is given by all other partners of the firm.

GST Registration Documents required for LLPs

Limited liability partnerships (LLPs) are subject to specific LLP documentation requirements for GST registration, reflecting the unique structure and governance of these entities. The documentation process plays a crucial role in establishing the legitimacy and compliance of the LLP, enabling seamless transactions and adherence to tax regulations. The following are the essential GST Registration documents required for LLPs:

- LLP Agreement: A legal document defining the rights, duties, and obligations of the partners, as well as the internal governance structure of the LLP.

- Certificate of Incorporation: Certificate of Incorporation issued by the Registrar of Companies, conclusively proving the Incorporation of LLP.

- PAN Card of the LLP: A Permanent Account Number (PAN) issued by the Income Tax Department, serving as a unique identifier for the LLP.

- PAN, Identity and Address Proof of Partners: Documents such as an Aadhaar card, passport, voter ID, or driver’s license, along with proof of address, such as utility bills or bank statements, and PAN for all partners.

- Address Proof of the LLP’s Registered Office: Documents establishing the physical location of the LLP’s registered office, such as rent agreement, lease deed, or property tax receipt.

- Bank Account Details: Details of the LLP’s bank account, including the bank statement or passbook.

- Photographs of Partners: Passport-sized photographs of all partners, duly attested.

- Letter of Authorisation: A Letter authorizing the applicant / authorized signatory to sign the incorporation application on the company’s letterhead. The authorisation is given by all other partners of the LLP.

Process of GST Registration for Partnership Firm and LLP

Navigating the GST registration process is essential for partnership firms and limited liability partnerships (LLPs) to ensure compliance with tax regulations and facilitate seamless business operations. This section provides a step-by-step guide outlining the process of GST registration tailored specifically for partnership firms and LLPs.

By following the below steps meticulously, businesses can complete the registration process efficiently and embark on their journey towards GST compliance.

Step 1: Visit the GST Portal

Begin by accessing the official GST portal (www.gst.gov.in), which serves as the primary platform for GST registration and related services.

Step 2: Initiate New Registration

Select the “New Registration” option and choose the “Taxpayer” category to initiate the GST registration process for your partnership firm or LLP.

Step 3: Fill Part A of the GST Registration Application

Provide basic details such as business name, PAN, email address, and mobile number in Part A of the GST registration application form.

Step 4: OTP Verification

Verify your mobile number and email address by entering the OTP (One Time Password) received on the registered mobile number and email.

Step 5: Complete Part B of the Application

After successful verification, proceed to fill Part B of the GST registration application form, providing additional details about the partnership firm or LLP, partners/members, business activities, and other relevant information.

Step 6: Upload Required Documents

Upload scanned copies of the necessary documents, including partnership/LLP deed, PAN cards, Aadhar cards, address proofs, bank details, and documents related to the registered office.

Step 7: Submit the Application

Review the information provided and submit the GST registration application form electronically on the GST portal.

Step 8: Generation of ARN

After submission, an Application Reference Number (ARN) will be generated and sent to your registered email and mobile number.

Step 9: Verification & Scrutiny of Application

The GST registration application will be scrutinized by the tax authorities, and any additional documents or clarifications may be requested, if necessary.

Step 10: Receipt of GSTIN

Upon successful verification, a GST Identification Number (GSTIN) will be issued for your partnership firm or LLP, completing the GST registration process.

Conclusion

The GST registration process for partnership firms and LLPs requires meticulous attention to detail and adherence to regulatory requirements. By understanding the significance of LLP and Partnership Firm GST registration documents and preparing them diligently, businesses can ensure legal compliance, access input tax credits, and foster seamless operations in the dynamic Indian taxation landscape. We hope this blog has cleared all your doubts related to documents required for GST Registration of Partnership Firms & LLPs.