MSME Registration of Wholly Owned Subsidiary of Foreign Company

Overview : Despite its foreign origin, a Wholly-Owned Subsidiary of a Foreign Company can take MSME Registration in India provided it meets the eligible criteria. The criteria is based on annual turnover and investment limits generated and received in India. Also, the process to be followed is exactly the same as that for a domestic company, where an Indian Resident Director of the company is authorised to fill out the MSME Registration application.

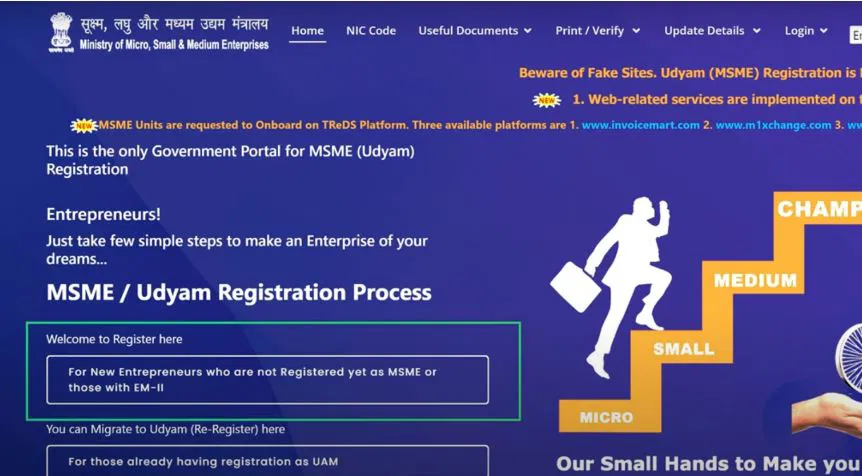

The application for MSME Registration of a Wholly-Owned Subsidiary is filed on the Udyam Registration Portal. Several crucial details of the enterprise, and the authorised director are provided for proper MSME classification. Once registered as MSME, the wholly-owned subsidiary can avail various benefits from the Government and financial institutions. For more information, read the blog further.

Eligibility Criteria for MSME Registration of a Wholly-Owned Foreign Subsidiary Company

Despite having a foreign origin, a Wholly Owned Subsidiary company gets incorporated within India and is eligible for MSME Registration like any other domestic company. However, it needs to meet the threshold limits of net investment and net turnover as mentioned in the table below.

| MSME Classification | Turnover Limits | Investment Limits |

|---|---|---|

| Micro Enterprises | Up to Rs.5 crores | Up to Rs.1 crore |

| Small Enterprises | Up to Rs.50 crores | Up to Rs.5 crores |

| Medium Enterprises | Up to Rs.250 crores | Up to Rs. 10 crores |

Documents Required for MSME Registration of Wholly-Owned Subsidiary Company

Before beginning the MSME Registration procedure of a subsidiary company, it is necessary to keep certain documents handy. These documents are not needed for submission but are rather required to verify the information provided in the application. Here’s the complete list for your reference.

- Company’s PAN

- Authorised Director’s Aadhaar, linked with the Registered Mobile Number

- GSTIN, if applicable

- Proof of Residence / Ownership at the Business Premises

- Blank Cheque to verify the official bank account details,

- LLP Deed, and Incorporation Certificate

MSME Registration of Wholly-Owned Subsidiary Company

An eligible Wholly-owned subsidiary company can apply for MSME Registration with the same process as other domestic companies. The authorised signatory, one of the company’s Indian resident directors, can file an online application on the Udyam Registration Portal. All the details filled out must be authentic and verifiable according to their original documents. Once the application process gets completed, a unique MSME Registration number is assigned and an MSME Certificate is issued in the company’s name. Here’s a detailed stepwise guide:

- Visit the online Udyam Portal udyamregistration.gov.in/Government-India/Ministry-MSME-registration.htm

- Select the option “MSME Registration for New Entrepreneur”.

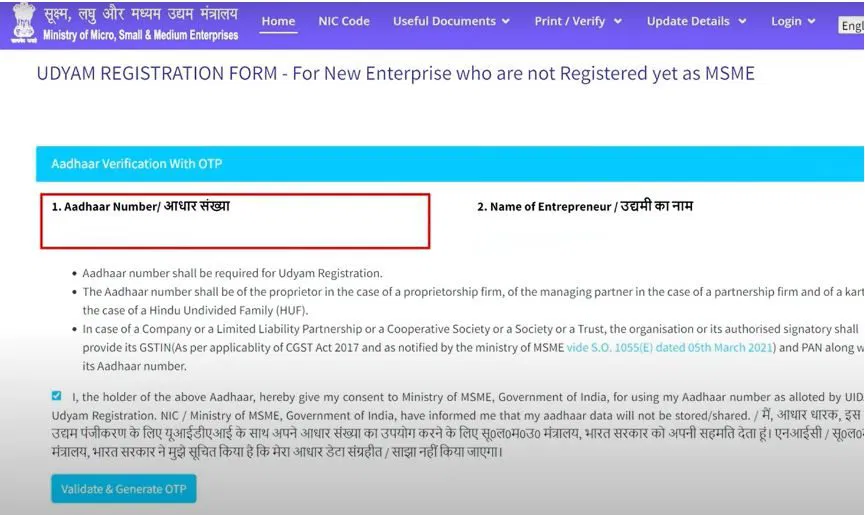

- Next, register at the Udyam Portal using the Aadhar Number and name of the authorised director. The Aadhar Number must be linked to the mobile number of the director, so that an OTP can be sent to verify his identity.

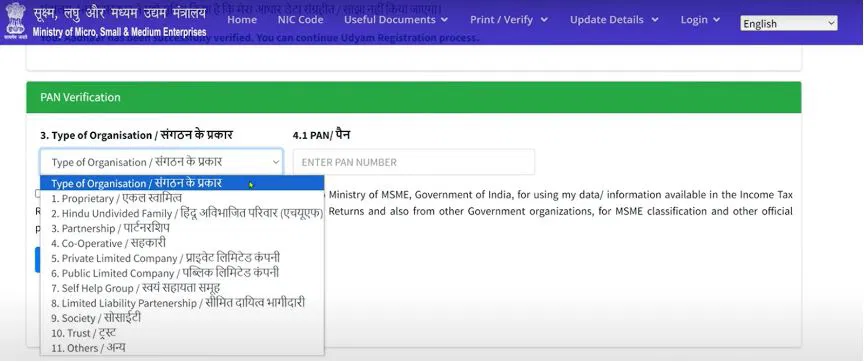

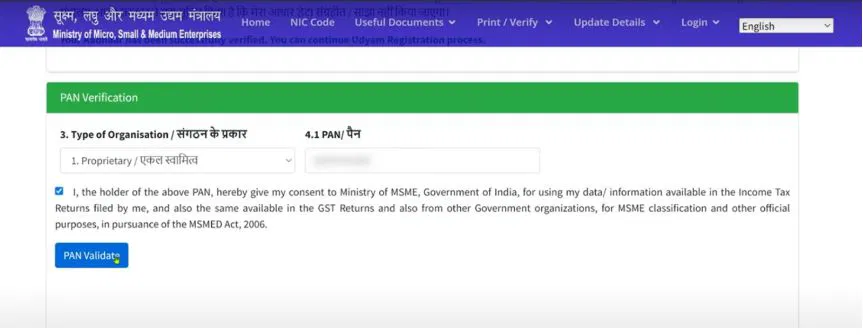

- Next, select the Type of Organisation as “Others” since Wholly-Owned Subsidiary is not given as an option in the dropdown.

- Enter the company’s PAN. It will automatically be validated from the Income Tax database.

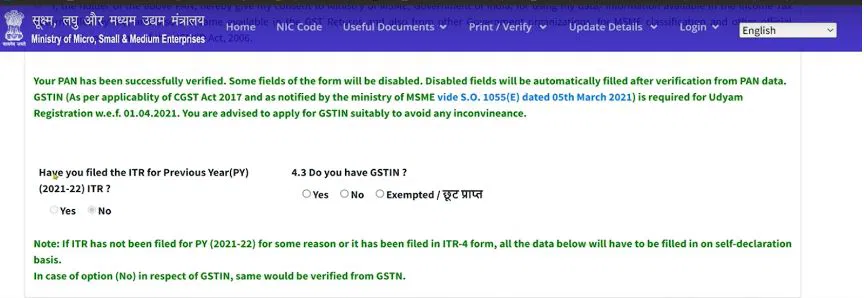

- Next, select the ITR filing status of the subsidiary company in the previous financial year. Also confirm the availability of its GSTIN. Both these details will enable the verification of investment and turnover details in the form.

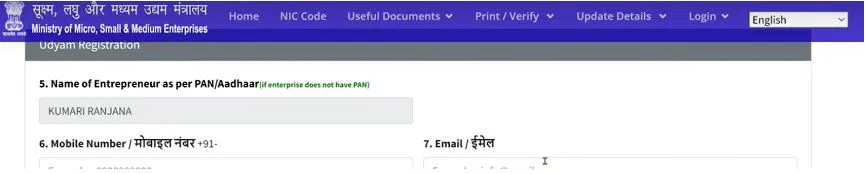

- Enter the mobile number and email of the authorised resident director.

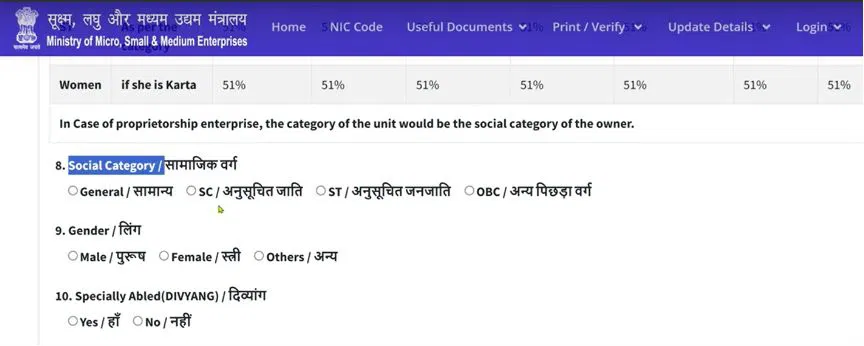

- Enter the Social Category, gender, and specially-abled status of the authorised director.

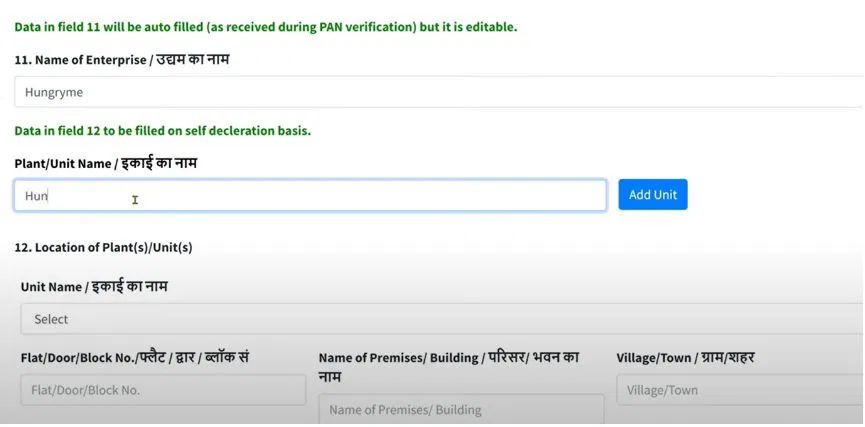

- Next, enter the subsidiary company’s name, along with the name and address of its manufacturing plants in India.

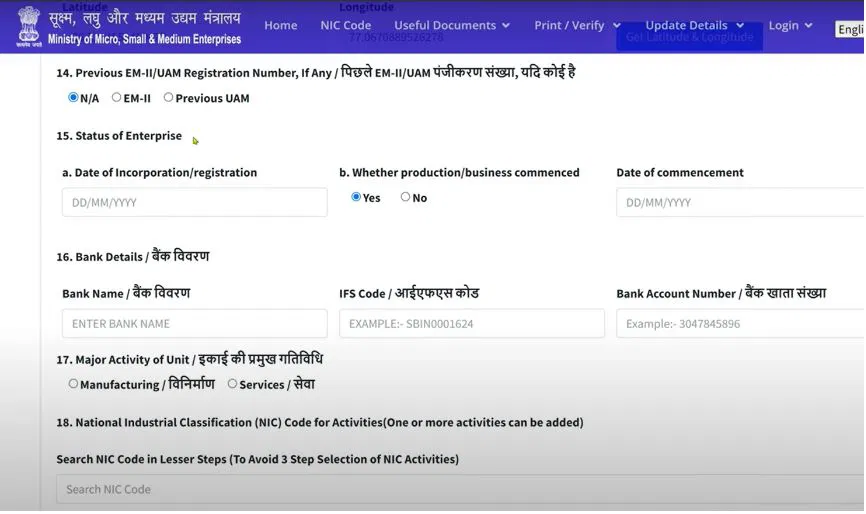

- Enter the incorporation details, business commencement details, bank details, and business activity of the subsidiary company classified as per the NIC code.

- Enter the number of male, female, and other category employees.

- Self-declare the turnover and investment details of the subsidiary company.

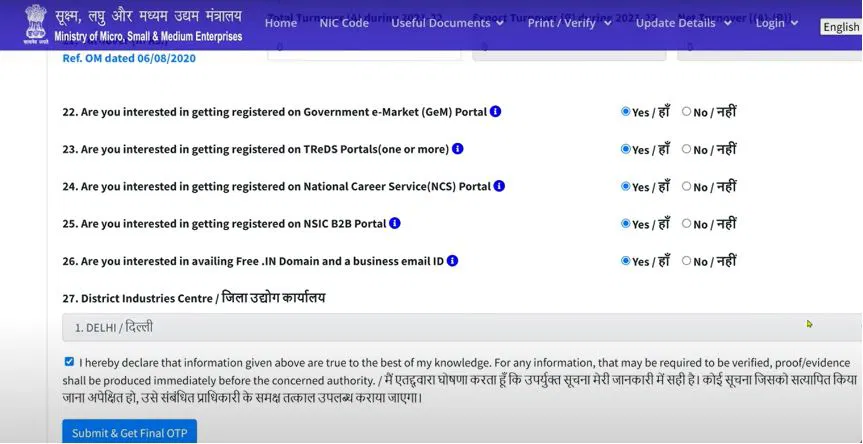

- Confirm the last few details and then agree to the given declaration. Finally, validate the authrorised signatory’s identity using an OTP sent to his mobile number before final submission.

- Within a week, an MSME Certificate will be issued in the subsidiary company’s name. It can be downloaded from the Udyam website, following the procedure discussed further.

How to Download / Print the MSME Certificate of a Wholly-Owned Subsidiary Company?

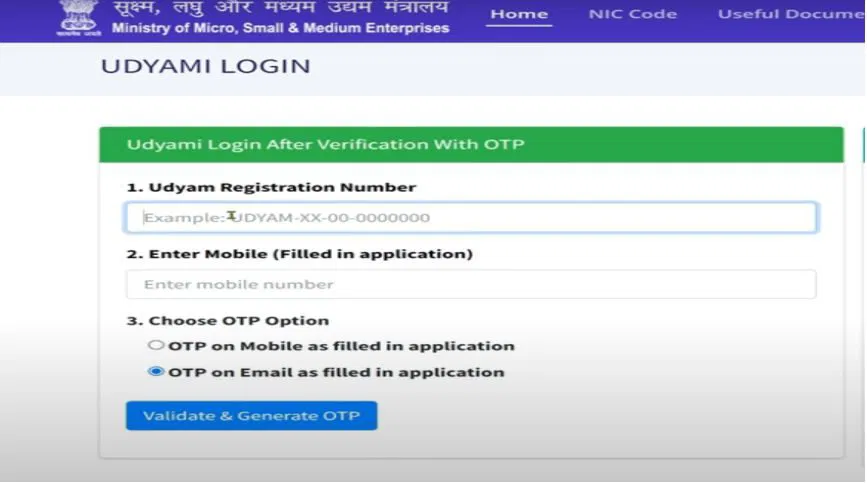

For downloading the MSME Certificate, the authorised person needs to visit the Udyam Portal and provide the MSME Registration Number, assigned soon after the submission of the MSME application. Also, the registered mobile number of the authorised director is required for OTP verification. The detailed steps are explained below.

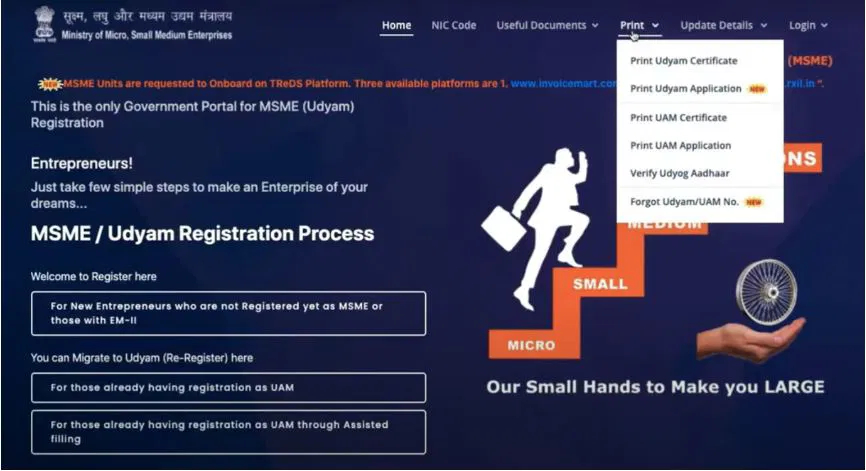

- Go to the Udyam Portal and Click on the “Print” option. From the dropdown, click on “Print Udyam Certificate”.

- Enter the Udyam Registration Number and the Mobile Number to generate OTP. Get OTP on the registered email or mobile number.

- Finally, click on the “Print Certificate” option and download or print the MSME Certificate of the subsidiary company.

Conclusion

MSME Registration process of a Wholly Owned Subsidiary can conveniently be conducted online. However, to avoid any discrepancies, entrepreneurs must approach expert service providers or legal advisors. At Setindiabiz, we take care of the MSME Registration process from start to finish. Our consultants guide you through every step, and verify every information before the application is finally submitted on the Udyam Portal. To avail our assistance, contact our advisors now!